It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of HYCM

Pros:

- Wide range of financial instruments available for trading.

- MT4 and MT5 trading platforms available, as well as a proprietary platform called PrimeTrader.

- A free demo account is available for traders to practice without risking their real money.

- Multilingual customer service available 24 hours a day, 5 days a week.

- HYCM offers an Islamic account for traders who require an interest-free account.

- Regulation by the FCA of the United Kingdom, CYSEC of Cyprus and CIMA of the Cayman Islands.

Cons:

HYCM General Information and Regulation

HYCM is a UK-registered forex broker and regulated by the Financial Conduct Authority (FCA), the Cyprus Securities Commission (CYSEC) and the Cayman Islands Monetary Authority (CIMA). With a track record of over 40 years in the market, HYCM has established itself as a leading broker in the foreign exchange trading industry.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering you easy and well-organized information. If you are interested, read on.

Regulators

HYCM is regulated by three major financial regulatory bodies: the Financial Conduct Authority (FCA) of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) and the Cayman Islands Monetary Authority (CIMA). They are all globally recognized regulators and have a high reputation in the financial industry. The FCA is known to be one of the strictest and most demanding regulators in the world, and its regulation is considered to be one of the most rigorous and reliable in terms of customer protection. On the other hand, CySEC is the financial services regulatory authority in Cyprus, a country known for its attractive regulatory and tax environment for investment firms. And finally, CIMA is the financial regulator for the Cayman Islands, a British overseas territory. Together, these three regulations offer strong customer protection and increased security for financial transactions conducted through HYCM.

What type of broker is HYCM?

HYCM is a Forex and CFD (Contracts for Difference) broker that offers access to a wide variety of financial markets through its online trading platform. As a broker, HYCM acts as an intermediary between its clients and the financial markets, allowing traders to buy and sell financial instruments without having to physically own them.

HYCM operates under a Dealing Desk, which means that bid and ask prices are set by the company itself. This can be beneficial for traders looking for more stable and fixed spreads, but it also means that HYCM may have a conflict of interest with its clients. To mitigate this risk, HYCM offers a Dealing Desk trading account, which allows traders to trade at direct market prices.

Market instruments

HYCM offers its clients a wide variety of trading instruments, which means that traders can trade in different markets and have a greater diversification of their portfolios. In terms of currency pairs, HYCM offers a selection of the major and most popular pairs, such as EUR/USD, USD/JPY, GBP/USD, and many others. In addition, traders can also trade a variety of precious metals, such as gold and silver, and commodities such as crude oil. A selection of indices is also offered, including the S&P 500, the FTSE 100 and the Nikkei 225. HYCM also offers its clients the possibility to trade stocks of some of the world's largest companies, such as Apple, Microsoft and Amazon. Finally, HYCM offers the option to trade cryptocurrencies, including Bitcoin, Ethereum and Litecoin. This means that traders can have access to some of the most volatile and exciting markets in the world, which can provide unique trading opportunities and potential profits.

Spreads and commissions for trading with HYCM

1. HYCM charges variable spreads for its operations, which vary according to the type of account and trading instruments.

2. HYCM charges an inactivity fee of $10 per month after 3 months of account inactivity.

3. HYCM charges a commission of $4 per side for raw account transactions.

Trading accounts available at HYCM

HYCM offers three types of trading accounts, with a minimum deposit of $100 for the classic/fixed account and $200 for the raw account. The available accounts are:

Fixed account: the Fixed account offers floating spreads starting from 1.5 pips, Min. position volume of 0.01 lot and allows trading more than 300 financial instruments, including currencies, commodities, indices and cryptocurrencies. In addition, a free demo account is offered for practice and learning, as well as an Islamic account.

Classic account: the classic account offers spreads starting from 1.2 pips and a commission of $0 per lot traded. The min. position volume is 0.01 lot and also allows trading of more than 300 financial instruments.

Raw account: the raw account offers spreads starting from 0.1 pips and a commission of $4 per lot traded. The main difference between the raw account and other accounts is that it has a minimum deposit of $200.

HYCM is also proud to offer a free demo account, allowing traders to practice and familiarize themselves with the trading platform before investing their real money.

Operating platform offered by HYCM

HYCM's MT4 platform is one of the most popular and widely used in the world of online trading, with a large user base worldwide. With this platform, traders can access multiple technical analysis tools, customizable charts, technical indicators and expert advisors (EAs). In addition, traders can use the backtesting function to evaluate the effectiveness of their trading strategies and adjust them as needed.

On the other hand, HYCM also offers the MT5 platform for those who are looking for a more advanced trading platform. The MT5 platform is an enhanced version of MT4, with more advanced tools and features. The MT5 platform also offers the hedging function, which means that traders can simultaneously open long and short positions on the same instrument, which can be useful in certain trading strategies. In addition, MT5 also allows traders to access more markets and types of financial assets, including futures and options.

HYCM maximum leverage

HYCM offers a maximum leverage of 1:500 for currencies, which means that traders can trade with a position of up to 500 times their initial capital. This can significantly increase potential profits, but also increases the risk of losses.

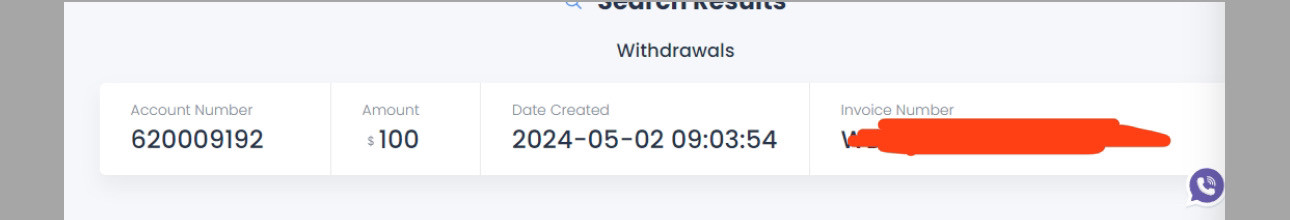

Deposit and Withdrawal: methods and fees

HYCM offers a wide variety of deposit and withdrawal options, making it easy and convenient for traders to deposit and withdraw funds. Traders can make deposits using a variety of methods, including bank transfers, credit and debit cards, popular e-wallets such as Neteller and Skrill, and other online payment methods such as Perfect Money.

The minimum deposit amount is only $20, which is an advantage for those who wish to try HYCM without having to deposit large sums of money. In addition, HYCM does not charge any deposit fees, which means that traders can deposit any amount they wish without worrying about additional charges.

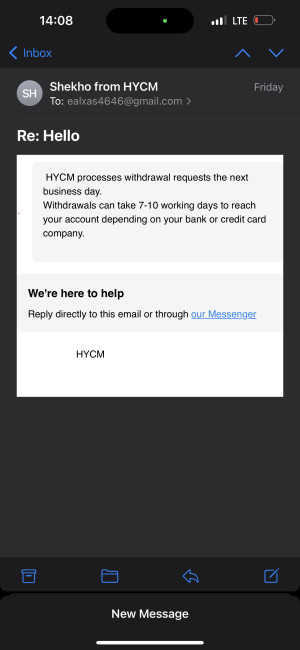

When it comes to withdrawals, HYCM processes withdrawal requests within 24 hours for some payment methods, which is a fast processing time compared to other brokers. Traders can withdraw funds using the same payment methods used to make deposits. There are no withdrawal fees at HYCM, which means that traders can withdraw their profits without having to worry about additional costs.

It is important to note that withdrawal processing times may vary depending on the payment method and the trader's banking institution. HYCM strives to process all withdrawal requests as quickly as possible, but there are factors beyond its control that may affect processing time. Overall, HYCM offers a wide variety of deposit and withdrawal options, as well as fast processing times and no additional fees, making it an excellent choice for traders looking for a reliable and convenient broker.

Education at HYCM

One of the additional advantages of HYCM is that it offers a wide range of educational tools to help traders improve their trading knowledge and skills. This includes live webinars, online seminars, trading guides, video tutorials and much more. HYCM is committed to helping its traders achieve their trading goals and maximize their earning potential.

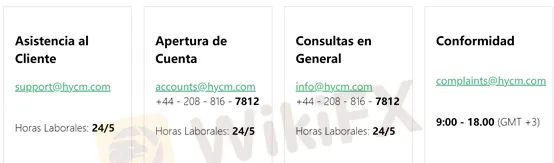

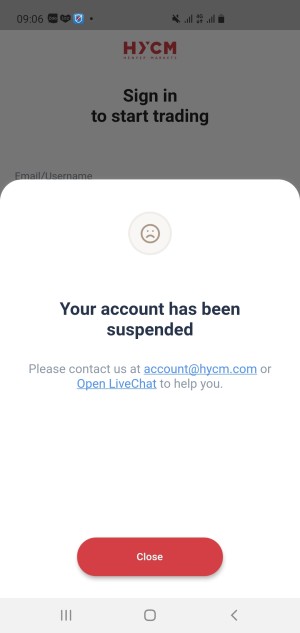

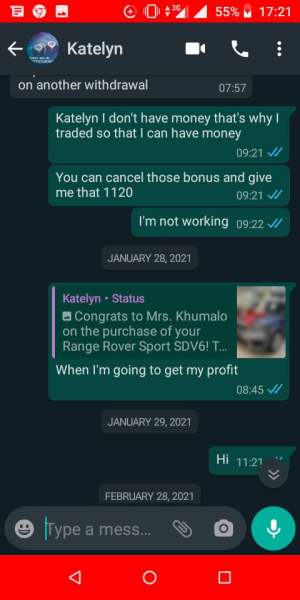

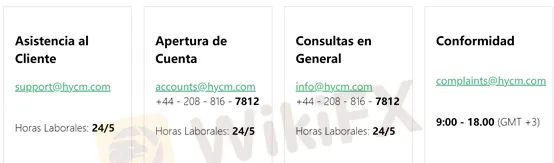

HYCM Customer Service

HYCM offers 24/5 customer support in several languages, including English, Spanish, German, French and several other languages. Traders can contact the support team by phone, email and live chat. They also have a FAQ section on their website to help traders find answers to common questions.

E-mail: support@hycm.com

Conclusion

Overall, HYCM is a reliable and well-regulated forex broker that offers a wide range of trading instruments and trading platforms. With its focus on transparency and security of client funds, HYCM is an excellent choice for traders of all experience levels. In addition, its wide range of educational resources and exceptional customer service make HYCM an excellent choice for traders looking to improve their skills and knowledge in the Forex market.

Frequently asked questions about HYCM

Question: Does HYCM offer a demo account?

Answer: Yes, HYCM offers a free demo account for traders to test the platform and practice their trading strategies without risking their own money.

Question: What is the minimum deposit to open an account in HYCM?

Answer: The minimum deposit to open an account in HYCM is $100 USD.

Question: What trading platforms does HYCM offer?

Answer: HYCM offers a variety of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Question: Does HYCM offer leverage?

Answer: Yes, HYCM offers leverage for traders. The maximum leverage offered depends on the trading instrument and country regulation.

Question: Does HYCM charge transaction fees?

Answer: On classic and fixed accounts, HYCM charges a spread fee for its trades, which means that it does not charge commissions per trade. But on the raw account there is a commission.

Question: Does HYCM offer educational resources for traders?

Answer: Yes, HYCM offers a wide range of educational resources for traders, including trading courses, live webinars, educational articles and trading strategies on its website.

Question: Is HYCM regulated?

Answer: Yes, HYCM is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CYSEC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX