Score

FXTM

United Kingdom|10-15 years| Benchmark AAA|

United Kingdom|10-15 years| Benchmark AAA|https://www.forextime.com?utm_source=fxeye.com&utm_medium=display&utm_content=fxeye_propage_en_hp&utm_campaign=hp&utm_term=na&utm_blocka=mediabuy

Website

Rating Index

Benchmark

Benchmark

AAA

Average transaction speed (ms)

MT4/5

Full License

ForexTime-ECN-Zero-demo

Influence

A

Influence index NO.1

India 6.46

India 6.46Benchmark

Speed:A

Slippage:AAA

Cost:AA

Disconnected:AAA

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

Nigeria

NigeriaInfluence

Influence

A

Influence index NO.1

India 6.46

India 6.46Contact

+100%

+100% 2*CPU

2*CPU 2G*RAM

2G*RAM 60G*HDD

60G*HDD 2M*ADSL

2M*ADSL- The number of the complaints received by WikiFX have reached 26 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed FXTM also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Singapore Singapore | 796*** | EURUSD | 02-13 08:00:01 |

Shanghai Shanghai | 832*** | EURUSD | 02-13 08:00:01 |

Singapore Singapore | 553*** | EURUSD | 02-13 08:00:01 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Hong Kong

Taiwan

China

Nigeria

Afghanistan

South Africa

fxtm.com

Server Location

United States

Website Domain Name

fxtm.com

Server IP

104.26.6.67

futuo-mkt.biz

Server Location

Hong Kong

Website Domain Name

futuo-mkt.biz

Server IP

47.75.96.75

fxtm.com.gh

Server Location

United States

Website Domain Name

fxtm.com.gh

Server IP

104.18.34.21

Genealogy

VIP is not activated.

VIP is not activated.Richtmfx

FXTIME

Fake FXTM

Relevant Enterprises

Company Summary

| Quick FXTM Review Summary | |

| Founded | 2011 |

| Registered Country | United Kingdom |

| Regulation | FCA, FSC (Offshore) |

| Trading Instruments | Forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs |

| Demo Account | ✅ |

| Account Type | Advantage, Advantage Plus, Advantage Stocks |

| Min Deposit | $/€/£/₦200 |

| Leverage | Up to 1:3000 |

| Spread | Close to zero on major FX pairs |

| Trading Platform | MT4, MT5, mobile trading |

| Payment Method | Credit/debit cards, e-wallets, bank wire transfers and local payment solutions |

| Deposit Fee | €/£/$3 or ₦ 2,500 fee for any deposit under €/£/$30 or ₦25,000 |

| Customer Support | 24/5 live chat, contact form |

| Tel: +44 20 3734 1025 | |

| Regional Restrictions | The USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People's Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus, Myanmar, Russia and India |

FXTM Information

FXTM, or Forex Time, is a global forex and CFD broker founded in 2011. It is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Commission (FSC) in Mauritius. FXTM offers a variety of trading instruments, including forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs. In terms of trading fees, FXTM offers variable spreads on most of its instruments, with spreads close to 0 pips.

FXTM also offers multiple choices of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available in desktop, web, and mobile versions, which allows traders to trade on the go and from anywhere in the world.

FXTM Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

| |

| |

| |

| |

|

Is FXTM Legit?

FXTM operates under a strong regulatory frame, and it has several entities that are regulated in different jurisdictions:

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| FCA | Exinity UK Ltd | Straight Through Processing (STP) | 777911 | Regulated |

| FSC | EXINITY LIMITED | Retail Forex License | C113012295 | Offshore regulated |

Market Instruments

FXTM offers over varioustradable instruments, covering forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs. However, this broker does not currently support trading on futures, options, and ETFs.

| Tradable Assets | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| CFDs | ✔ |

| Futures | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

FXTM offers three different types of trading accounts, which are the Advantage account, the Advantage Plus, and the Advantage Stocksaccount. All accounts require a minimum deposit requirement of 200. Each account type has its own unique features and benefits, such as different spreads, commissions, and trading instruments.

Demo Account

FXTM offers demo accounts for all its account types. These demo accounts allow traders to test their trading strategies in a risk-free environment using virtual funds. Demo accounts are also useful for new traders who want to learn how to trade before committing real money to live trading.

How to Open an Account?

- To open an account with FXTM, you first need to visit their website and click on the “OPEN ACCOUNT” button on the top right-hand corner of the page.

- This will take you to the account registration page where you will need to fill out some basic personal information like your name, email address, and phone number.

- Next, you will be asked to choose the type of account you want to open. FXTM offers three main account types - Advantage, Advantage Plus, Advantage Stocks, each with its own features and benefits. You will also need to select the base currency of your account and agree to the terms and conditions of the broker.

- Once you have selected your account type and base currency, you will be prompted to provide some additional personal information like your date of birth, occupation, and address. You will also need to answer a few questions about your trading experience and investment goals.

- After you have completed the registration process, you will need to verify your account by providing some additional documents like a copy of your ID or passport and a proof of address like a utility bill or bank statement.

- Finally, once your account is verified, you can then make your first deposit and start trading.

Leverage

FXTM offers leverage of up to 1:3000. It's recommended to use leverage wisely and only trade with funds you can afford to lose.

Spread and Commission

For the Advantage account, the spreads start from 0.0 pips, and $3.5 per lot traded on FX is charged. For the Advantage Plus account, the spreads start from 1.5 pips, but no commission. For the Advantage Stocks account, the spreads start from 6 cents, but no commission.

The spreads offered by FXTM are typically lower than those offered by many other brokers in the industry, particularly on the Advantage account. The Advantage Plus account, however, has slightly higher spreads, which is to be expected due to no commissions.

| Account Type | Spread | Commission |

| Advantage | From 0.0 pips | $3.5 per lot traded on FX |

| Advantage Plus | From 1.5 pips | ❌ |

| Advantage Stocks | From 6 cents | ❌ |

Trading Platform

FXTM offers three chocies of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as their proprietary mobile trading app.

FXTM Copy Trading

FXTM Invest is an advanced copy trading feature offered by FXTM, designed to make trading accessible to investors of all experience levels. With a low entry threshold of just $100, this platform allows users to automatically replicate the trades of experienced Strategy Managers. FXTM Invest stands out for its attractive pricing model, offering zero spreads on major FX pairs and a performance-based fee structure where investors only pay when their chosen Strategy Manager generates profits.

The process of getting started with FXTM Invest is streamlined into five simple steps: signing up or logging in to MyFXTM, selecting a Strategy Manager, opening an Invest account, making a deposit, and then watching as the system automatically copies your chosen manager's trades. This user-friendly approach, combined with the ability to maintain full control over your funds, makes FXTM Invest an appealing option for those looking to tap into the forex market with the guidance of seasoned professionals.

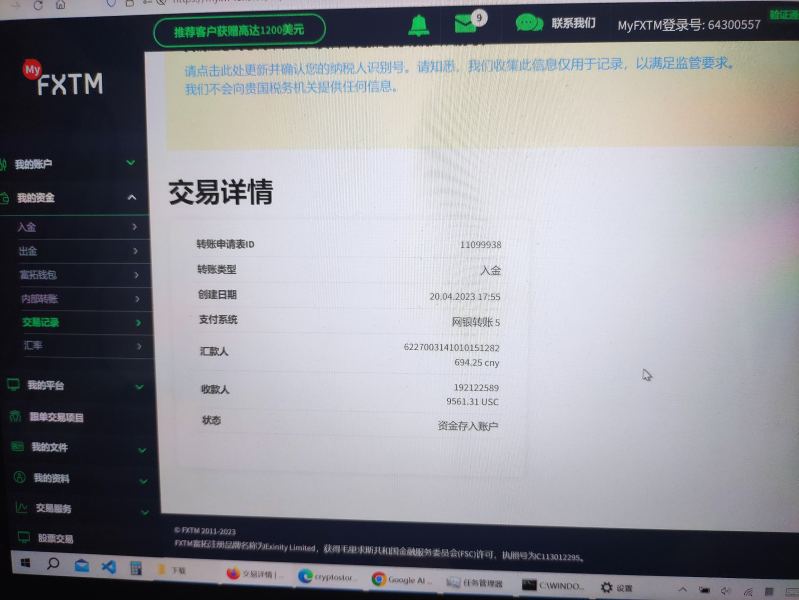

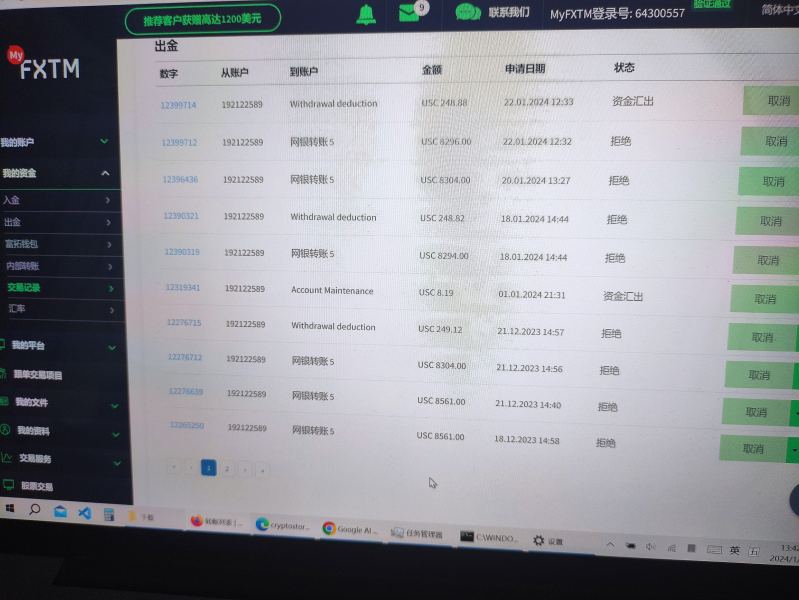

Deposit and Withdrawal

FXTM offers a variety of deposit and withdrawal options for its clients. Traders can deposit funds into their trading account using Kenyan/local transfers (local Indian payment methods: UPI and Netbanking, local Nigerian instant bank transfers, equity bank transfer, Ghanaian local transfer, Africa local solutions, M-Pesa, FasaPay, TC Pay Wallet), credit cards (Visa, MasterCard, Maestro, Google Pay), e-wallets (GlobePay, Skrill PayRedeem, Perfect Money, Neteller), and bank wire transfer.

FXTM charges €/£/$3 or ₦ 2,500 fee for any deposit under €/£/$30 or ₦25,000.

Educational Resources

FXTM offers various free educational resources including glossary, market analysis and guides.

Besides, their educational resoucres are friendly both for beginners and professionals.

For example, trading basics are suitable for beginners who want to learn some basics, while advanced guides are more suitable for traders who are experienced.

Customer Support

FXTM is known for providing excellent customer support to its clients, including live chat, contact form and phone. The customer support team is available 24/5 and is multilingual, which means clients can communicate with them in their preferred language.

FXTM also provides an extensive Help Center section on their website that covers various topics, such as account opening, deposit and withdrawal methods, trading platforms, and more. This section is helpful for clients who prefer to find answers to their questions without contacting the support team.

Conclusion

To sum up, FXTM is a well-regulated and respected forex broker with a wide range of market instruments, competitive trading conditions, and user-friendly trading platforms. FXTM's customer support is also responsive and helpful, and their free educational resources are very useful for both novice and experienced traders.

FAQs

Is FXTM legit?

Yes, FXTM is regulated by FCA and FSC (Offshore).

What trading instruments are available on FXTM?

FXTM offers a range of trading instruments including forex, metals, commodities, stocks, indices, cryptocurrencies, and CFDs.

What is the minimum deposit required to open an account on FXTM?

$/€/£/₦200

What trading platforms are available on FXTM?

FXTM offers three chocies of trading platforms including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as mobile trading.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

2024 SkyLine Thailand

- 10-15 years

- Regulated in United Kingdom

- Regulated in South Africa

- Straight Through Processing (STP)

- Financial Service Corporate

- MT4 Full License

- MT5 Full License

- Self-developed

- Global Business

- Suspicious Overrun

- High potential risk

News

News 2025 FXTM Comprehensive Review

Description: This article provides a thorough review of FXTM from multiple perspectives, including its basic introduction, fees, safety, account opening, and trading platforms.

2025-02-17 13:38

Review 【今日汇市】12月18日交易策略

技术策略:美元/加元 (USD/CAD) –惨遭利空重重围困,加元刷新疫后低点日线图看,因遭特朗普关税,通胀汇率助长降息预期,以及政Z动荡等因素重重围困,加元创出疫情来的4年多新低。走势看,美加加速上破11月来宽幅震荡升势上轨,呈现超强攻势。后续阻力需追溯到2020年3月31日反弹高点1.4350,随后料1.4400整数关预计也有一定抛压。下一中短期目标瞄准2022-23年跌势的1.618倍映射位

2024-12-18 11:40

News Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

2024-11-22 15:41

Exposure NBI PH Rescues 84 Filipinos from Alleged Forex Trading Scam in Pampanga

NBI Philippines rescues 84 Filipinos in Pampanga, from a scam hub posing as a BPO allegedly involved in FXTM USDT Forex Trading. Authorities target cybercrime violations in the Philippines.

2024-09-25 17:03

Exposure CySEC Revokes FXTM's CIF License After Voluntary Renunciation

CySEC withdraws FXTM's CIF license following the company's voluntary renunciation, marking a significant exit from the EU market for the trading firm.

2024-05-27 13:43

Exposure This Broker is Providing Services in India against RBI Warning

"FXTM is providing services to clients in India against an RBI warning." a user from India filed a complaint against FXTM dated January 6, 2024 On Wikfx,.

2024-01-09 18:07

Comment 96

Content you want to comment

Please enter...

Comment 96

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX9971484472

South Korea

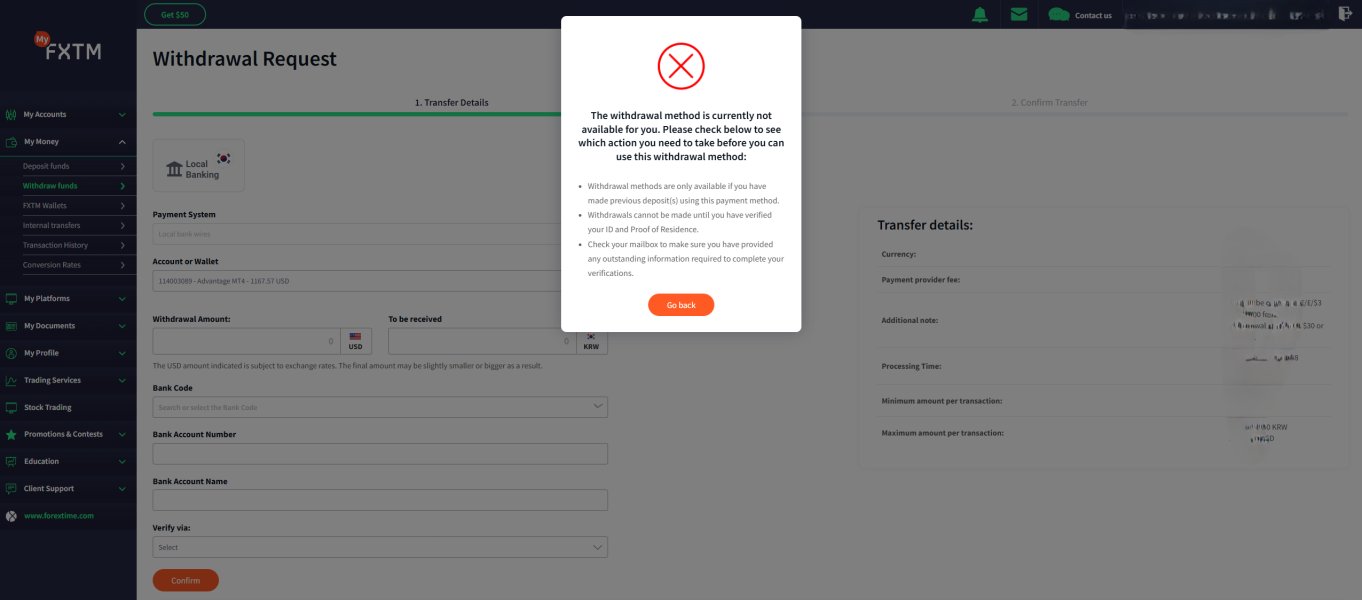

When trying to withdraw to a local bank, a message pops up saying to make a deposit first. Local bank deposits have been blocked since when? I don't understand why they say there is no record of a deposit. Even though it is clearly shown in the transaction history. Anyway, I received confirmation that the deposit confirmation and other documents have been processed. Even though it has been confirmed, the messages continue to appear. If you want to withdraw in coins, it says to use the local bank initially entered. I sent the deposit confirmation and error message asking for confirmation, but it continues to not work even though it says it has been processed. This clearly seems to be a withdrawal delay. If possible, I think I need to sort out the remaining accounts as well.

Exposure

01-24

苹果ID941

United States

I often can't log into my account, it says the username or password is incorrect, but they are not. I even changed my password via SMS, but still couldn't log in. I added a manager from the official website on WeChat, we chatted briefly and then they stopped replying; further inquiries were also ignored. Previously, I had several accounts under this login, but when I tried to access them six months later, all accounts had disappeared even though the username and password were correct. Recently, I couldn't log in at all with these credentials. Accessing their official website is very unstable, sometimes I can't get through at all. Even if there is money in your account, you can't log in, you have no way to withdraw it.

Exposure

2024-12-29

FX3495737278

United States

I deposited through cryptocurrency but did not receive the funds in my account, and customer service did not respond.

Exposure

2024-12-07

john775

United States

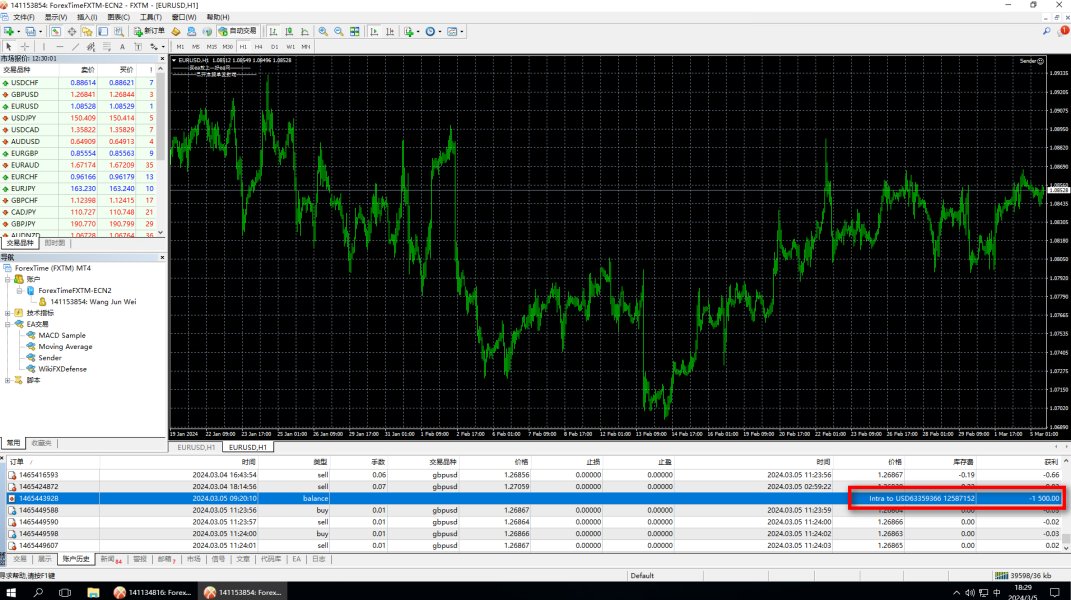

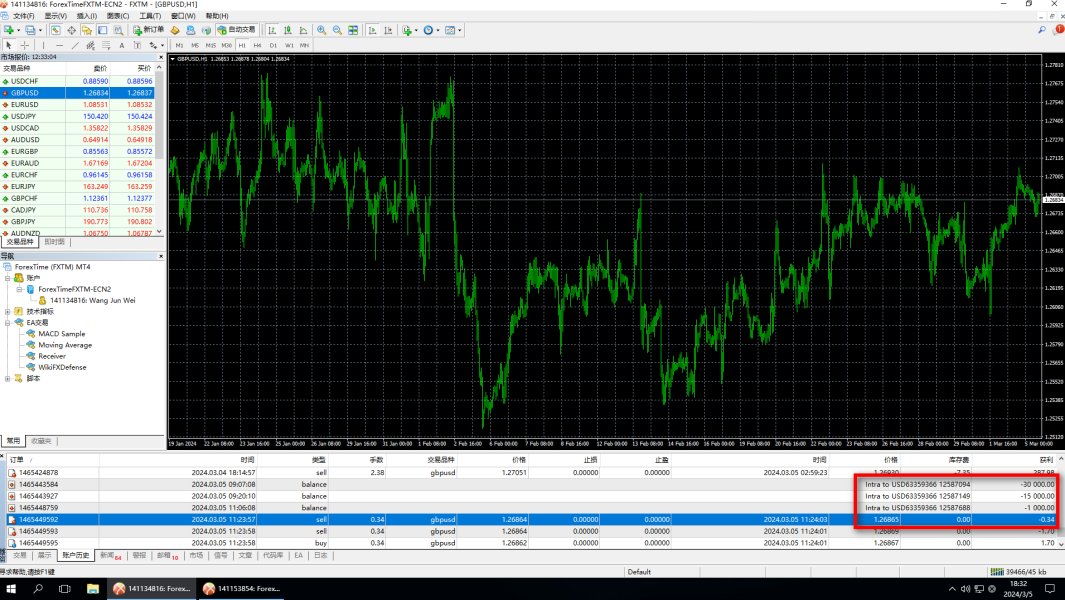

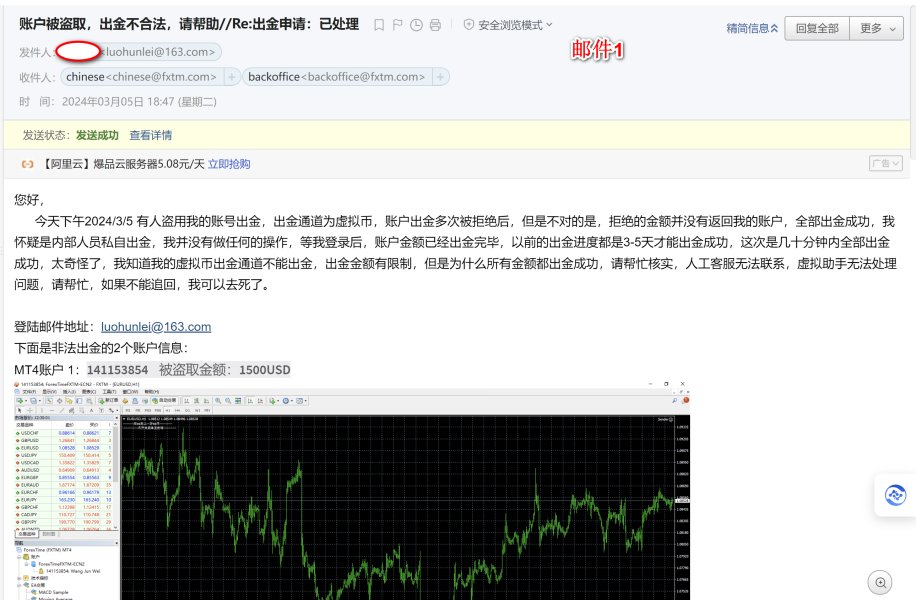

On the afternoon of March 5, 2023, I suddenly received 5 text message reminders that the withdrawal was successful. I thought it was a joke, so I went to the toilet with a smile. Thinking that something was wrong, I quickly logged in to the account. All the funds in the account were suddenly transferred to Fu. I opened my USD wallet and was withdrawing money like crazy. I quickly changed my password and I was still withdrawing money during the modification process. Since I didn’t leave the account manager’s phone number at that time, all the previous manual customer pages of FXTO turned into robots, turning me into a robot. I was so anxious that I could only send an email to the official to stop my withdrawal. My total account balance was about 53,000USD. 1,700USD was transferred out to 1,500 USD from the first account, and 46,000USD was transferred out from the second account, which was about 52,000USD. I held a position margin. It was not enough to close the position. I took 15,000USD from the virtual currency channel of the wallet, leaving more than 30,000 USD. The withdrawal was completed very quickly in more than ten minutes. My wallet address was bound and verified, but the 15,000USD withdrew did not arrive in my account. Wallet, I quickly took out the remaining amount through the bound bank card. Futuo is too unsafe. The platform even withdraws funds without personal verification and cannot guarantee the safety of funds. The final reply from customer service said that my email information was leaked to ensure that third parties cannot access my email. The key problem is that Futuo did not make any The verification code will not be sent to the email address, so what is the use of accessing my email address. This led to my debt crisis, with a total loss of over 20,000USD

Exposure

2024-03-18

Lovecpm

United States

It has been impossible to withdraw funds since December, and the handling fees deducted when withdrawing funds will not be returned. The reasons used include incomplete information, wrong bank information, unaccounted handling fees, in short, various reasons for not withdrawing funds. To put it bluntly, I just want to keep delaying until all the idle and withdrawal fees are deducted! This is a scam platform! Don't be fooled!

Exposure

2024-01-24

Sancho Roy

India

ForexTime's blatant disregard for Indian legalities is appalling. Despite being deemed illegal in India, they persist in servicing Indian clients, jeopardizing their safety. I've lodged a complaint with the Ombudsman of Mauritius, urging swift action to suspend their FSC Mauritius license unless they cease Indian operations immediately. This unethical conduct must not go unnoticed; I urge everyone to think twice before engaging with Forextime. Is offering services in a banned country ethical or unethical? It's unequivocally unethical. Explicitly stating non-compliance with Indian laws on their reply to my email while profiting from Indian residents is audacious . Anyone can check the official website of the Reserve Bank of India to verify it's illegal status. My account closure is a result of my complaint against Forextime to the Financial Services Commission, Mauritius. They engage in illicit practices by accepting deposits through local Indian banks, a clear violation amounting to money laundering. Registering with them poses a significant risk, as they might shut down at any time, leading to the loss of your funds. It's highly requested to not sign up and fall for a dubious platform.

Exposure

2024-01-06

12584612

United Arab Emirates

This is a very sinister boss. This broker has fallen by more than 100 points, and they deducted IB's rebate. I brought them 4 big clients, don’t work with them, don’t trade with this broker, don’t bring them clients, they are a bunch of scammers, this is my account manager, I want to expose everything about them

Exposure

2023-11-13

Erkek5036

Turkey

I have deposited money into my account. They have NOT ENTERED a BONUS. And when I want to withdraw my money without trading, they suggest that my account has not been approved. Even though I have sent all my documents for 15 days, there has still been no approval.

Exposure

2023-09-06

12584612

United Arab Emirates

This is a scammer company, their trading account has slipped by more than 100 points and they do not give IB rebates. I brought four clients who closed my IB account and wiped out all commissions. My loss is $10000. Don't trade with them, you will suffer heavy losses and cannot make a profit.

Exposure

2023-08-14

ahmad6034

Palestine

I withdrew balance to cryptocurrencies and the scheduled time is one hour from 00:55 pm, but until now no balance has arrived.

Exposure

2023-07-15

Wajahat.qd

Pakistan

send now i los my everything for this orgnization pliz someone help me i want my this withdrwal

Exposure

2023-04-01

Kinoko

Japan

Deny the withdrawal for various reasons before. The attitude of customer service is extremely perfunctory. The withdrawal request suddenly passed in 26th, but cannot receive the fund for a long time

Exposure

2022-04-28

Kinoko

Japan

I was induced to deposit money step by step before. Now 75% of the account balance is my principal, but it said that I need to pay 50% of the account balance as personal income tax to resume the withdrawal business. I consulted professionals in Japan and told me such a requirement is unreasonable. I really have no money. I have borrowed 940,000 yen from a friend for the platform anniversary event and illegal payment. Now my friend has no money to lend me any more to pay taxes. I hope the platform can help me get an explanation.

Exposure

2022-04-24

Kinoko

Japan

Picture[1] On April 9th, a friend told me that the business had an anniversary event and asked me to contact customer service to see if I had the right to participate, so I was confused and passively participated. Figure [2] On April 10th, the first application for withdrawal of funds failed. The customer service refused to withdraw funds on the grounds that the anniversary activities were not completed, and said that the activities that were not completed within the specified time would be handed over to the judicial department and reported for levy letter. Figure [3] On April 11th, I borrowed money from a friend. Due to the transfer limit, I made a deposit of 320,000 yen and completed 50% of the progress of the activity. Figure [4] The platform could not be accessed on April 12th and 13th, the official statement is system maintenance and upgrade; on April 14th, the deposit of 331,000 yen was completed to complete the anniversary event. Figure [5] On April 14th, the second withdrawal failed. The customer service asked me to pay 20% of the account balance as the violation fee on the grounds that my account maliciously attacked the platform system data and caused a high profit violation, otherwise the account will be frozen. On April 15th, deposit 342,500 yen as a deposit. Figure [6] On April 17th, the deposit arrived. Figure [7] From April 18th to 22nd, I contacted customer service about the withdrawal of funds, and I have been inquiring all the time, but there is no result; I later informed that the profit part needs to pay 50% of the account balance as personal income tax before the withdrawal can be resumed. business. Figure [8] On April 24th, the illegal payment was refunded to the account. Figure [9] On April 24, it was found that the account main body of the old version was inconsistent with the account main body of the new version. I asked customer service, the customer service explained it, and sent an email to Exness's official mailbox for verification, but no reply was received.

Exposure

2022-04-24

PR3M4N

Indonesia

Be Aware ! especially for asian people. you cannot depo using bank transfer and fxtm force you to use visa/master debit/credit card. When you try to wd, your payment option will not available, and they ask for bank statement that include your car with transaction to fxtm which will not available if you use visa debit. STAY AWAY FROM THIS BROKER !!

Exposure

2021-12-24

FX3417794782

Singapore

Do not trust this platform http://www.fxtmvip.com/. You cannot withdraw from them

Exposure

2021-12-08

Khitish Dash

India

open an account the deposit took almost 2 seconds using credit card when I tried to withdraw they asked me for 1- national ID card photos 2- credit cart photos 3- bill or tax photos which takes time to be processed and time to be verified and time to be accepted and time to be refund until now i could not withdraw !! 400$ in their website and they take charges for each day if I am not trading

Exposure

2021-08-16

Mayaz Ahmad

Bangladesh

A client has complained that he applied for withdrawal but they kept his withdrawal pending for days, asking for numerous documents. He has also complained that they charge on deposit on days when no trade is done.

Exposure

2021-08-03

Mayaz Ahmad

Bangladesh

A client has complained FXTM closed his trade without informing him and without any valid reason. He has also complained about other unethical practices of this broker.

Exposure

2021-06-27

FX2009239286

Nepal

some candlesticks different from tradingview and other brokers

Exposure

2021-06-15