General information

Trade Nation is an online forex broker registered in United Kingdom and well regulated by ASIC, FCA and SCB. Trade Nation is authorized and regulated by prominent regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Securities Commission of The Bahamas (SCB), and the Australian Securities and Investments Commission (ASIC). Since its founding, Trade Nation has prioritized the provision of a wide variety of tradable assets. Traders can access a diverse selection of forex currency pairs, commodities, indices, allowing them to capitalize on various market opportunities.

Leverage is a key aspect of trading, and Trade Nation understands the importance of providing competitive leverage options. With leverage ratios of up to 1:200, traders can potentially amplify their trading positions and maximize their potential profits. It's crucial to note that leverage involves risks and should be used responsibly.

To cater to traders' preferences, Trade Nation offers a range of advanced trading platforms, including MetaTrader 4 (MT4) and its proprietary platform, Trade Nation Platform. These platforms are renowned for their user-friendly interfaces, advanced charting tools, and comprehensive trading features.

Trade Nation takes pride in its exceptional customer support, offering multilingual assistance through various channels, including live chat, email, and phone support. Recognizing the importance of knowledge and education in trading, Trade Nation provides a range of educational resources. Traders can access comprehensive educational materials, including tutorials, webinars, articles, and trading guides.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Is Trade Nation legit or a scam?

Trade Nation, a forex broker operating globally, takes regulatory compliance seriously. The broker operates under the regulation of three regulatory authorities, ensuring that it adheres to stringent regulatory standards and maintains the highest level of integrity.

Firstly, TRADE NATION AUSTRALIA PTY LTD, a subsidiary of Trade Nation, is regulated by the Australian Securities and Investments Commission (ASIC). ASIC is renowned for its robust regulatory framework and strict oversight of financial services providers in Australia. By being regulated by ASIC, Trade Nation ensures compliance with Australian financial regulations, client fund protection, and fair trading practices.

Secondly, TRADE NATION FINANCIAL UK LTD, another entity of Trade Nation, falls under the regulation of the Financial Conduct Authority (FCA) in the United Kingdom. The FCA is one of the most respected financial regulatory bodies globally, known for its rigorous oversight and investor protection measures.

Lastly, Trade Nation Ltd operates under the regulation of the Securities Commission of The Bahamas (SCB).

Pros and Cons

Trade Nation offers a range of advantages to traders, including strong regulation by reputable authorities such as FCA, SCB, and ASIC. Additionally, Trade Nation provides user-friendly trading platforms and excellent customer support services. However, it has some limitations, such as a limited range of tradable instruments and the absence of Islamic (swap-free) accounts. Furthermore, the availability of localized customer support may be limited, and the educational resources provided by Trade Nation are not as extensive as some competitors.

Market instruments

Trade Nation offers a range of market instruments to cater to the trading preferences of its clients. These instruments include indices, commodities, and forex currency pairs. Traders can access a variety of global indices, enabling them to speculate on the performance of specific stock markets or sectors. Additionally, Trade Nation provides a selection of commodities, allowing traders to trade on the price movements of popular commodities such as gold, silver, oil, and agricultural products. Furthermore, forex currency pairs are available for trading, providing traders with the opportunity to participate in the foreign exchange market. It's important to note that trading these instruments involves inherent risks, including market volatility and economic factors that can impact their prices.

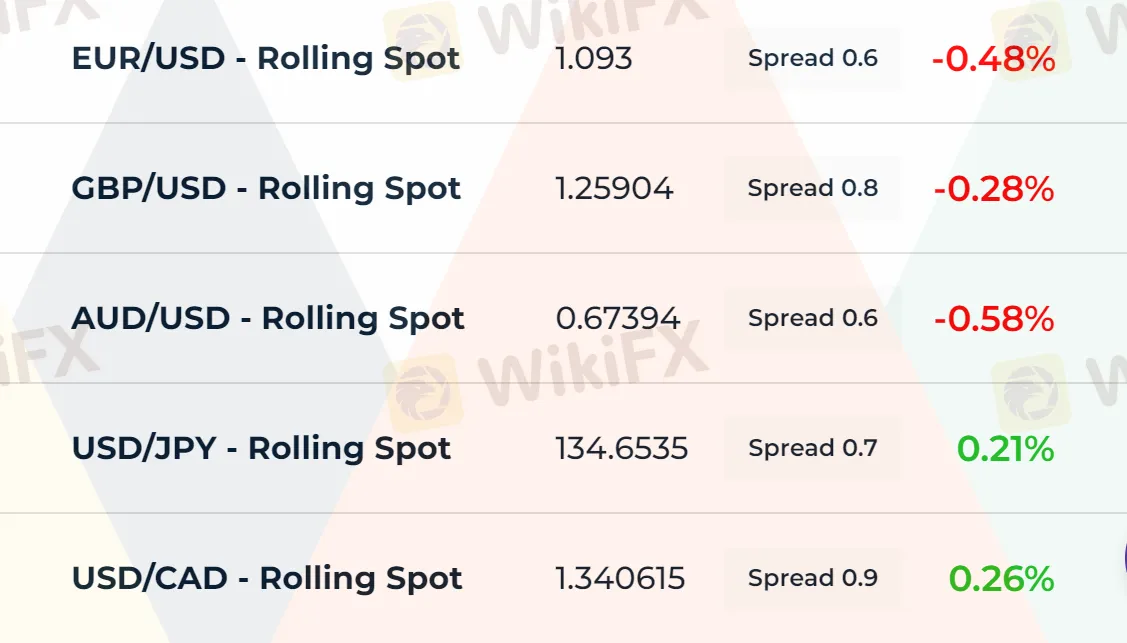

Spreads and commissions for trading with Trade Nation

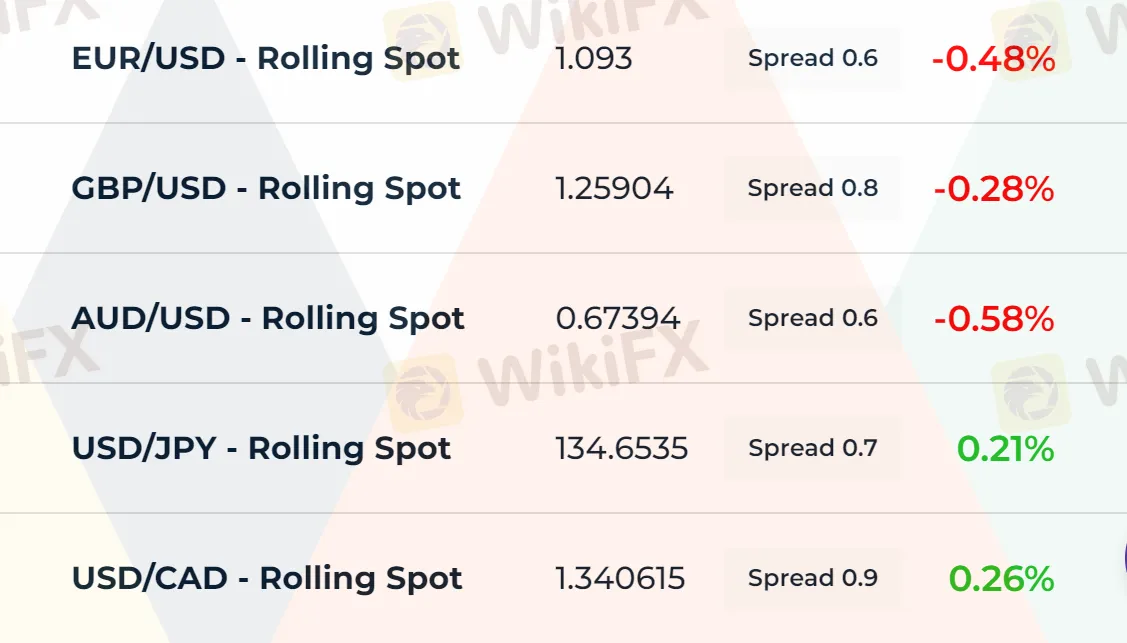

When it comes to spread offerings, Trade Nation seems to offer relatively competitive rates on popular currency pairs. For instance, the EUR/USD pair typically carries a spread starting from as low as 0.6 pips, while the GBP/USD pair boasts spreads starting from 0.8 pips. Additionally, the USD/JPY pair enjoys spreads starting from 0.7 pips. These tight spreads indicate the potential for lower trading costs, enabling traders to optimize their profit margins. It's important to note that spreads may vary depending on market conditions, volatility, and the specific account type chosen by the trader.

Regarding commissions, specific details may vary depending on the account type and Trade Nation does not provide specific information about commissions.

Non-Trading Fees

Traders should be aware of the non-trading fees associated with their trading activities. These fees, separate from the trading costs, may vary depending on the specific services and features utilized. One of the non-trading fees to consider is the deposit and withdrawal fees. It is essential to be aware of any potential fees associated with depositing funds into the trading account or withdrawing funds from it.

Another aspect to consider is the inactivity fee. Trade Nation may charge an inactivity fee if there is no trading activity on account for an extended period. Traders should be mindful of this fee and the conditions under which it applies to ensure they meet the required trading activity or take appropriate actions to avoid it.

Additionally, currency conversion fees should be taken into account, especially when trading instruments denominated in different currencies. Trade Nation may apply fees or charges for converting funds between currencies, and traders should familiarize themselves with the specific terms and rates associated with such conversions.

Account Types for Trade Nation

Trade Nation offers traders the opportunity to open a demo account and a live account. This account structure provides traders with options to experience simulated trading through the demo account and engage in real-time trading with the live account.

The demo account offered by Trade Nation allows traders to practice their trading strategies and familiarize themselves with the trading platform without risking any real money. It serves as an excellent tool for beginners to gain confidence and understanding of the markets before transitioning to live trading.

The live account is designed for traders ready to engage in real-money trading. It provides access to a wide range of tradable assets, including forex, commodities, indices, and more. The minimum deposit requirement to open a live account is $0, which offers accessibility for traders of all levels.

How to open an account?

Opening an account with Trade Nation, a reputable forex broker, is a straightforward process that can be completed in a few simple steps. Whether you are a beginner or an experienced trader, Trade Nation strives to make the account opening process quick and convenient. Here is a step-by-step guide on how to open an account:

Visit the official Trade Nation website: Start by accessing the official Trade Nation website at https://tradenation.com/. Click on “Trade Now” or a similar button on the website's homepage. Clicking on this button will take you to the account registration page.

2. Fill in the required information: On the account registration page, you will be prompted to provide some personal information. This may include your name, email address, contact details, and other relevant information. Ensure that the information you provide is accurate and up to date.

3. Complete the application: Once you have provided the necessary information and selected your preferred account type, carefully review the terms and conditions, risk disclosure, and other legal documents. Make sure you understand and agree to the terms before proceeding.

4. Account verification: As part of the account opening process, you may be required to provide identification documents for verification purposes. This is a standard procedure to ensure the security and compliance of the platform.

5. Fund your account: After your account is successfully verified, you can proceed to fund your trading account. Trade Nation offers multiple deposit options, including bank transfers, credit/debit cards, and electronic payment methods. Choose the most convenient option for you and follow the instructions provided.

6. Start trading: Once your account is funded, you can access the trading platform provided by Trade Nation. Familiarize yourself with the platform's features, tools, and trading instruments. You can then begin executing trades based on your trading strategy and market analysis.

Trading platforms offered by Trade Nation

The MetaTrader 4 (MT4) platform offered by Trade Nation is widely recognized and preferred by traders worldwide for its advanced features, user-friendly interface, and robust performance.

The MT4 platform is renowned for its extensive range of technical analysis tools, allowing traders to conduct in-depth market analysis and make informed trading decisions. Traders can access a wide selection of charting tools, indicators, and drawing tools to analyze price movements, identify trends, and pinpoint potential entry and exit points.

One of the key advantages of the MT4 platform is its customizable interface, allowing traders to personalize their trading environment according to their preferences. Traders can arrange charts, add or remove indicators, and save customized templates for efficient analysis. Additionally, the platform supports multiple timeframes, enabling traders to analyze price action across different time intervals.

Another notable feature of the MT4 platform is its automated trading capabilities through the use of Expert Advisors (EAs). Traders can develop or install EAs to automate their trading strategies, enabling them to trade around the clock without the need for constant monitoring.

Leverage offered by Trade Nation

When opening an account under the Financial Conduct Authority (FCA), which is a regulatory body in the United Kingdom, the maximum leverage available is typically limited to 1:30. This means that for every $1 of capital, traders can control up to $30 in trading volume. The FCA imposes this limitation to ensure the protection of retail traders and mitigate the risks associated with high leverage.

But if you open an account under the Securities Commission of The Bahamas (SCB), a different regulatory authority, the leverage offered can be higher, such as up to 1:200. This higher leverage allows traders to have more flexibility in their trading strategies and potentially generate greater profits. However, it's important to note that higher leverage also entails increased risk, as losses can be magnified.

Deposit and withdrawal methods and fees

Traders can choose from several reliable payment methods, including VISA, MasterCard, FPX, Bitcoin, and Grabpay. When it comes to making a deposit, Trade Nation sets a minimum deposit requirement of $0, allowing traders of all levels to start their trading journey. For withdrawals, Trade Nation strives to ensure prompt processing to provide clients with convenient access to their funds. The withdrawal process is straightforward, allowing traders to request their funds through their preferred method. It's important to note that certain payment methods may have specific terms and conditions or associated fees, which traders should be aware of before making their deposit or withdrawal.

Educational resources

A series of educational resources is available at Trade Nation, such as market information sheet, trading tools, technical analysis, fundamental analysis, forex open times, etcetera

Customer support of Trade Nation

Trade Nation offers multiple channels through which clients can contact their dedicated support team. One of the primary communication options is via phone support. Clients can reach out to Trade Nation's support representatives directly via phone, allowing for real-time assistance and immediate resolution of any queries or concerns.

Email support is another avenue through which clients can connect with Trade Nation's customer support team. By sending an email, clients can articulate their inquiries or issues in detail.

For clients seeking immediate assistance or quick answers, Trade Nation offers online chat support. Through the broker's website, clients can engage in live chat sessions with knowledgeable support agents. This feature facilitates instant communication, allowing clients to have their questions addressed in real-time and receive immediate guidance as they navigate the trading platform or any other related matters.

Clients can reach out to Trade Nation's customer support team via various social media channels, including Facebook, Twitter, and LinkedIn.

Below are the details about the customer service.

Language(s): English

Email: support@tradenation.com

Phone Number: +44 (0) 203 180 5952

Address: 14 Bonhill Street, London, EC2A 4BX, United Kingdom

Social media: Facebook, Instagram, LinkedIn, YouTube, twitter

Users exposures on WikiFX

We have not received any reports of fraudulent activity at this time. However, this does not necessarily mean that this broker is safe and you should remain vigilant to prevent being scammed.

Conclusion

In conclusion, Trade Nation, a forex broker registered in the United Kingdom and regulated by reputable authorities such as the FCA, SCB, and ASIC. The broker's strengths lie in its diverse selection of tradable assets, including forex currency pairs, commodities, indices, and cryptocurrencies, providing ample opportunities for traders to explore different markets. The availability of competitive leverage ratios up to 1:200 allows traders to potentially maximize their trading positions, although it should be used responsibly due to associated risks. However, it's important to note that Trade Nation, like any other broker, has some drawbacks. The absence of specific information on bonuses and promotions, as well as potential limitations on certain services, may be considered as areas for improvement.

FAQs

Q: Is Trade Nation a regulated broker?

A: Yes, Trade Nation is a regulated broker. It is registered in the United Kingdom and is regulated by reputable authorities such as the FCA (Financial Conduct Authority), SCB (Swiss Confederation Bank), and ASIC (Australian Securities and Investments Commission).

Q: What trading instruments can I trade with Trade Nation?

A: Trade Nation offers a wide range of tradable assets, including forex currency pairs, commodities, indices. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Q: What leverage is available for trading with Trade Nation?

A: Trade Nation provides competitive leverage ratios for trading, allowing traders to potentially amplify their trading positions. The leverage ratio offered may vary depending on the instrument and account type chosen.

Q: What trading platforms are available with Trade Nation?

A: Trade Nation offers traders access to advanced trading platforms, including the widely used MetaTrader 4 (MT4) platform. Additionally, the broker provides its proprietary Trade Nation Platform, which is a user-friendly and feature-rich trading platform.

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX